TAKE ACTION:

|

TAKE ACTION NOW! Click on the box below.

BACKGROUND:

Revise the Connecticut Health Care Tax on Ambulatory Surgery Centers

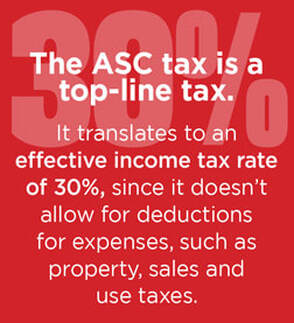

In 2015, the Connecticut General Assembly passed 11th-hour legislation at the close of the session that included a 6 percent gross receipts tax on ambulatory surgery centers. This tax translates to an effective income tax rate of 30 percent, as it does not allow for deductions for expenses, such as property, sales and use taxes. The impact of the tax is unprecedented and has a considerable negative impact on ambulatory surgery centers across the state.

The ASC tax has had a chilling effect on ambulatory surgery centers. Five years ago, according to the Connecticut Department of Labor, our industry was poised to grow 39% through 2024. Today we struggle just to stay afloat. Providing efficient healthcare services that improves health and reduces costs is being taxed to death.

Connecticut is one of only four states with an ASC tax. Among them, we have – by far – the highest rate in the nation. This isn’t healthy. Not for our patients and not for the health care providers that choose to operate efficient, innovative medical offices that make healthcare more effective and affordable.

More than 50 bills have been introduced to repeal, reduce or phase out the ambulatory surgery center tax. Last week, the legislature’s Finance committee – in a unanimous, bipartisan vote – advanced a bill (SB 1131) in favor of providing tax relief for the state’s ambulatory surgery centers.

We applaud and appreciate their efforts – it’s a step in the right direction, but fully repealing the onerous 6% ASC tax is the only way to stabilize an industry with significant economic impact to this state and to keep healthcare costs in check. Without independent ASC’s patients and their insurers would pay twice as much, and probably have to wait twice as long, to have their same-day surgical procedures in a hospital-owned facility.

The ASC tax is undermining the health of Connecticut residents and the viability of our industry, which is built on a business model far different than that of hospitals.

The ASC tax has had a chilling effect on ambulatory surgery centers. Five years ago, according to the Connecticut Department of Labor, our industry was poised to grow 39% through 2024. Today we struggle just to stay afloat. Providing efficient healthcare services that improves health and reduces costs is being taxed to death.

Connecticut is one of only four states with an ASC tax. Among them, we have – by far – the highest rate in the nation. This isn’t healthy. Not for our patients and not for the health care providers that choose to operate efficient, innovative medical offices that make healthcare more effective and affordable.

More than 50 bills have been introduced to repeal, reduce or phase out the ambulatory surgery center tax. Last week, the legislature’s Finance committee – in a unanimous, bipartisan vote – advanced a bill (SB 1131) in favor of providing tax relief for the state’s ambulatory surgery centers.

We applaud and appreciate their efforts – it’s a step in the right direction, but fully repealing the onerous 6% ASC tax is the only way to stabilize an industry with significant economic impact to this state and to keep healthcare costs in check. Without independent ASC’s patients and their insurers would pay twice as much, and probably have to wait twice as long, to have their same-day surgical procedures in a hospital-owned facility.

The ASC tax is undermining the health of Connecticut residents and the viability of our industry, which is built on a business model far different than that of hospitals.

Connecticut surgeons, medical societies, and others speak out on the health care tax on

ambulatory surgery centers that is unprecedented and unwarranted.

Amanda Gunthel, President - Connecticut Association of Ambulatory Surgery CentersBack in March, you heard me discuss the damaging effect that the 6% gross receipts tax has had on the ambulatory surgery center industry and the need for relief. Rather than focus on our challenges, today I would like to focus on the role our Centers play in providing high-quality care at a fraction of the cost of other providers.... (more)

Richard Searles, Specialty Surgery Center of ConnecticutThe 6% gross receipts tax has had a chilling effect on the ASC industry. Not only is it the highest tax in the nation (only 4 states even tax ASCs), the fact that it’s an “above the line tax” translates to an effective tax rate of 30%...So, ASCs are taxed both as a small business and as a health- care provider without enjoying the benefits of either category. (more)

|

Paul J. Schaeffer, MD - Middlesex Center for Advanced Orthopedic SurgeryBack in March, you heard me discuss the damaging effect that the 6% gross receipts tax has had on the ambulatory surgery center industry and the need for relief. Rather than focus on our challenges, today I would like to focus on the role our Centers play in providing high-quality care at a fraction of the cost of other providers.... (more)

Lynn Halkowicz, BSN, RN - NEMG Endoscopy CenterThe 6% gross receipts tax [on ASC's]... is it the highest in the nation... By maintaining the $1 million exemption through a waiver process and exploring other options for relief, you will begin the process of stabilizing [the ASC] industry, spurring further investment and economic growth in Connecticut, and allowing us to be part of the solution as you grapple with ever increasing health care costs....(more)

|